In the backdrop of an ongoing transformation in business environment,

Indian real estate is witnessing a robust rise in investment inflow as

both foreign and domestic institutional investors are infusing more

funds into the sector.

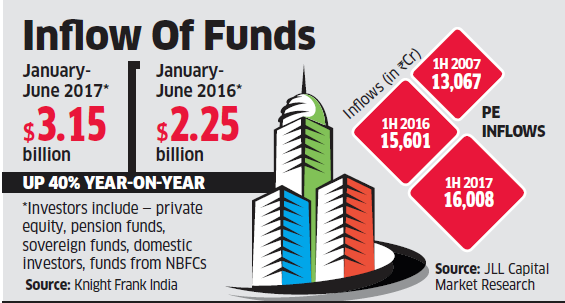

The Indian property market has posted a 40% on-year jump in inflow of

funds since the beginning of this year. Institutional investors,

including private equity, pension funds, sovereign funds, domestic

investors, and non-banking finance companies have pumped in $3.15

billion in the country’s real estate between January and June end,

showed a Knight Frank India study.

According to a separate study by JLL India, India has witnessed

private equity inflow of Rs 16,008 crore until June this year compared

with Rs 15,601 crore a year ago.

Over the past 18 months, the government has launched a number of

policy initiatives including the implementation of the Real Estate

Regulator Act (RERA), implementation of the Goods and Services Tax

(GST), Real Estate Investment Trusts and the demonetisation drive. "The

global economy has started recuperating with improving job prospects,

decline in unemployment rates and rising rate of inflation in the

developed economies. Investors in these countries are expecting

diminishing inflation adjusted returns. With the strengthening of

domestic currency they are finding assets in emerging markets (EMs)

cheaper from an investment perspective," said Samantak Das, Chief

Economist and National Director, Research, Knight Frank India.

Stable government and implementation of reforms such as the GST is

helping India attract the highest interest of global investors. Real

estate as the most important investment asset has witnessed a surge in

flow of foreign investments. With the sector undergoing a transformation

through the Real Estate (Regulation and Development) Act 2016,

affordable housing focus and the Real Estate Investments Trusts,

domestic investors have also joined the bandwagon.

"A slew of reforms unleashed by the government is changing the

investment scenario in the country and has made India one of the most

attractive emerging markets from an investment point of view. So much so

that a comparison between debt and equity investments seen between 2014

and first half of 2017, which stand at more than Rs 98,000 crore, are

higher than the Rs 95,000 crore seen during an entire decade from 2003

to 2013," said Shobhit Agarwal, MD - Capital Markets & International

Director, JLL India.

Among all the segments, commercial realty has witnessed the highest

interest from investors owing to falling capitalization rates. With low

yield environment and rates further expected to go down,

yield-generating commercial assets have been turning out to be a good

bet to generate healthy risk adjusted returns.

"Excess liquidity in the market has created compression in interest

rates that will lead to fall in capitalization rates in future, hence

locking such investments at higher yields will be helpful for

appreciation in capital values of these assets. Corporates are also

increasing head count as they are focused on growth due growing GDP

numbers thus leading to higher absorption. Overall, it has a momentum

impact in investment for commercial real estate," said Rubi Arya,

Executive Vice-Chairman of Milestone Capital Advisers.

Milestone Capital Advisors itself has invested in two offices in this quarter and are aggressively scouting for more opportunities.

Global investors, including Blackstone Group, Singapore's sovereign

fund GIC, Canada Pension Plan Investment Board (CPPIB), Goldman Sachs

and Qatar Investment Authority have already been investing in Indian

realty assets for the past few years. In addition to this, more funds

are eyeing investment and alliance opportunities.

Read all such Property News at CREDAI MCHI – Thane Unit website.

No comments:

Post a Comment